In February, my portfolio value decreased by $1,249 from 155,960 to $154,711. The TSX index performed relatively well. What dragged my portfolio was the telcos. Both Bell and Telus underperformed the markets in February. But I’m not too worried about that. It’s sure it's a buying opportunity for both stocks.

Dividends

Dividends received in February 2024: $743.44

Dividends received in February 2023: $670.93

Year-Over-Year Dividend Growth: $72.51 or 10.8%

Year-To-Date Dividend Income: $1,488.02

The dividend growth is at 10.8% compared to the same period of last year. The growth rate is sustained by dividend reinvesting and dividend increases.

Transactions

Bought 6 shares of Brookfield Renewable (BEPC.TO) for $33.69 per share

Bought 155 shares of Northwest Healthcare REIT (NWH.UN.TO) for $4.33 per share

All purchases were funded by dividends. As of 2024, I have a new contribution room of $7,000 in my TFSA Account. I didn’t start funding my TFSA yet because I’m prioritizing mortgage payments in the first half of this year. I will probably contribute to my TFSA in Q3. Meanwhile, I will continue reinvesting the dividends.

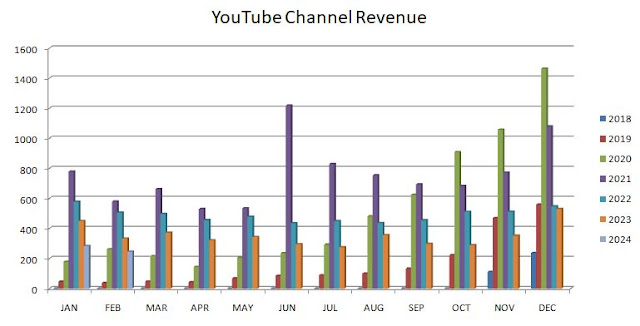

Ads Revenue

In February, I collected $246.31 in adsense revenue from my YouTube channel. It was a slow month again. The ad rates are down and the views are down too. I’m not worried about that, because my YouTube channel is only my hobby and whatever income I get from it is either used for investments or day-to-day spending.

February 2024 YouTube Stats:

Charts

- 116K Views

- Added 110 New Subscribers

- $246.31 Revenue

- Daily Average $8.49

Charts

February 2024 Summary

Portfolio Value: $154,711

Dividend Income: $743.44

AdSense Income: $246.31

Combined Income (excluding day job): $989.75

---

That’s it for February update! Let me know what you think of my progress. Feel free to share your progress in the comment section below. Thank you for reading and until next month!

No comments:

Post a Comment