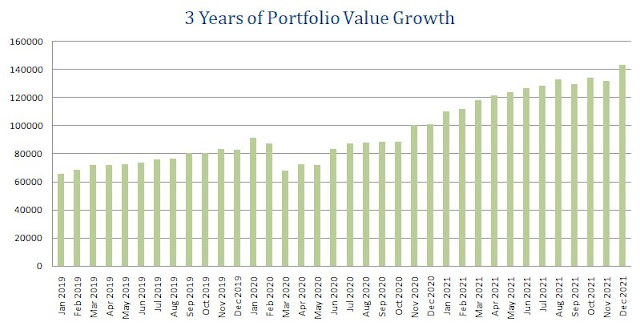

In November, my portfolio value increased by $1,057 from $144,807 to $145,864. It was a modest increase in value considering half the amount came from dividends. The year-end is around the corner. Let’s see how December month plays out.

Dividends

Dividends received in November 2022: $655.76

Dividends received in November 2021: $479.27

Year-Over-Year Dividend Growth: $176.49 or 36%

Year-To-Date Dividend Income: $6,744.27